Blog

VA Jumbo Loan Limits: What Factors Affect Jumbo Limits for Veterans?

I want to talk about a topic that’s super important for veterans looking to buy their dream home: VA Jumbo Loan Limits. Now, if you’re not familiar with VA jumbo loans, don’t worr...

Recent

VA Jumbo Loan Limits: What Factors Affect Jumbo Limits for Veterans?

I want to talk about a topic that’s super important...

March 18, 2024Unlocking the Potential: A Comprehensive Guide to VA Construction Loans in Arizona (2024 Edition)

Welcome to the latest edition of your go-to guide on VA c...

February 27, 2024Featured Articles

Recent

VA Jumbo Loan Limits: What Factors Affect Jumbo Limits for Veterans?

I want to talk about a topic that’s super important...

March 18, 2024Unlocking the Potential: A Comprehensive Guide to VA Construction Loans in Arizona (2024 Edition)

Welcome to the latest edition of your go-to guide on VA c...

February 27, 2024 Tips

TipsTaking Advantage of Lower Mortgage Interest Rates and Negotiating Opportunities

December 12, 2023

VA Construction Loans in California: How does it work?

November 9, 2023

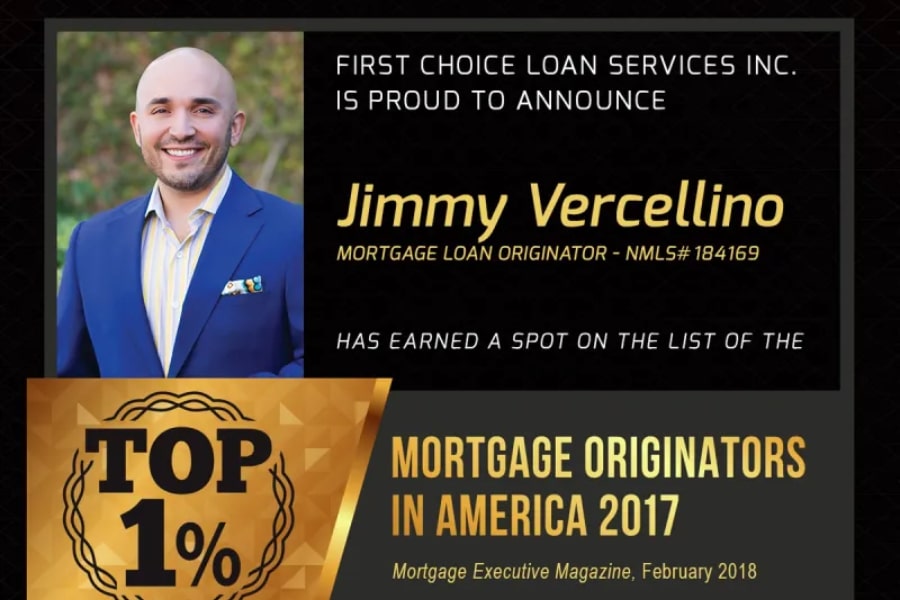

Living in The Home of your Dreams is Possible

If you want to settle down and provide your family with the home they’ve always wanted, don’t hesitate to contact me. I’ll be here to guide you every step of the way.